- RollCall by Rollfi

- Posts

- Cash vs. Equity: Amazon employees learn the hard way

Cash vs. Equity: Amazon employees learn the hard way

How you can learn from their mistakes

GM. This is RollCall by Rollfi!

The weekly newsletter talking about the future of work and crypto.

Here to keep your employees happy and rich.

Just like Barracuda.

Officially set up with @rollfi_xyz

@k17ubha & @Nik@NikhilRollfie all the stress out of the process and the onboarding process was smooth as 🧈

We sent the onboarding links out to our team and heard back 2 minutes later "that was easy" http

— Barracuda - The CRM Guys (@BarracudaIO)

3:01 PM • Feb 21, 2023

Make sure your employees are getting paid when they want, where they want, and how they want.

Rollfi allows you to pay employees in crypto, USD, or equity (coming soon). Plus, if you let Rollfi handle your benefits WE do your payroll for free.

Request a demo today👇

AMAZON EMPLOYEES

Amazon employees are pissed off.

First, they have to come back to the office.

Now, their salaries are tanking.

Let's dive in to see what's happening ...

Up until last year, the highest cash salary an Amazon employee could make was $160k (they bumped it up to $350k to compete for talent in the bull market). $160k is a lot for a normal job, but for an Amazon manager, it's nothing...

So how do they pay their talent?

Amazon employees accept a large portion of their salaries in something called RSUs (restricted stock units). RSUs are stock paid out to employees over time. Since Amazon employees receive a lot of their salary in Amazon equity, compensation fluctuates A LOT.

The thing is, most of the time this works out.

From 2015-2021 the average annual return on Amazon stock was 45%. If you take out 2021 (2% return), the average return was 52%.

However, last year was a different story. Amazon stock lost 50% of its value in 2022.

Just to show you how big of an effect this had on employees, let's run a hypothetical situation.

The year is 2018.

You just finished your 4th year at a hot marketing tech startup.

But your founder started taking private flights to the Dominican Republic, spending too much time at conferences, and now the top execs are leaving. The company is going downhill.

You're sick of the startup grind and you want a job with more stability.

You interview at Amazon and crush it. They say, “Hey, [insert your name] you’re a great fit. We’re going to offer you a job.”

GREAT.

But, you’re a senior staff engineer, which means you made $175k at the startup. You aren’t going to Amazon to change the world. You're going to Amazon because you want a stable job that makes more money. You won't settle for anything less than $200k.

That's where stock-based compensation comes in.

Amazon says they'll pay a cash salary of $160k salary + $200k in Amazon Restricted Stock Units (RSUs) over the next 4 years.

Amazon does a time-based vesting schedule called a 5-15-40-40. (Other schedules vest each month or evenly over 4 years like a 25-25-25-25).

Year 1: You receive 5% of the RSUs = $10,000, for a total compensation of $170k

Year 2: You receive 15% of the RSUs = $30,000, for total compensation of $190k

Year 3: You receive 40% of the RSUs = $80,000, for a total compensation of $240k

Year 4: You receive 40% of the RSUs = $80,000, for a total compensation of $240k

Your average salary if the stock price doesn't change = $210k. Boom you hit your goal. Plus the upside if the stock price increases.

Good news. The stock price went up! If your vested stock grew an average of 45%, like it did between 2015-2021, your stock would be worth close to $300k!

Then, 2022 came around. If you didn’t sell your stock before then, it's now worth close to $100k.

Here's what Amazon had to say about the situation employees are facing now:

“Our compensation model is intended to encourage employees to think like owners, which is why it connects total compensation to the company’s long-term performance. That model comes with some year-to-year upside and risk because the stock price can fluctuate, but historically at Amazon, it’s had a history of working out very well for people who’ve taken a long-term view.”

Translation: Historically it works out, but we can't promise anything

The model works “wen stock price go up”, but doesn't work out quite as well when the stock drops 50% in a year. To make up for the stock drawdown, Amazon plans on issuing raises from 1% to 4%.

Amazon isn’t the only company facing this problem. In the past year...

Google stock is down 30%

Netflix stock is down 20%

Shopify stock is down 32%

Fluctuations in the market and the growing competition for talent is why flexible compensation will be important for companies looking to hire the best talent.

Everyone from our parents to our grumpy finance professors told us the best investment we can make is buying stocks. "Max out your 401k’s". "Equity is better than cash."

Sometimes they're right and sometimes stocks don't appreciate in value. Always be intentional about how you structure your salary to equity tilt. Think about what you NEED cash for, where you can take more risks, and how you diversify your portfolio.

WATCH OUT FOR THE ETH DENVER HACK

If you're in crypto you may want to listen up here.

ETHDenver is starting on Friday.

And hackers are already trying to steal your crypto.

Here‘s how the scheme works:

Hackers copied ETHDenver’s website with similarly designed websites and spelled domains.

They paid Google to show up high on the search page.

Asked users to connect their wallet to the website

Emptied user’s wallets.

So far the smart contract has comprised 2,800+ wallets and stolen $300k+ in crypto.

Always triple-check what smart contract you connect your wallet to.

You never know….

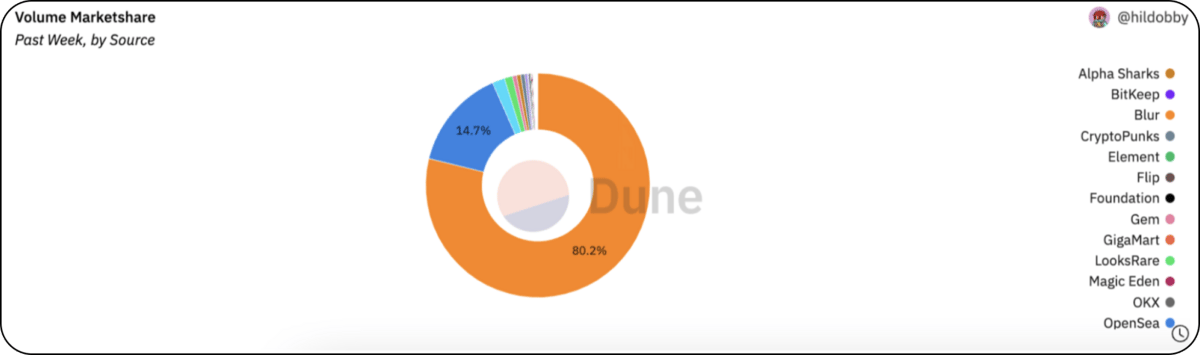

OPENSEA VS. BLUR

OpenSea is the king of the NFT marketplaces. They’ve dominated volume rankings since the beginning. But another player is trying to take the spotlight.

That player is Blur.

What is Blur? Blur is an NFT marketplace aggregator funded by Paradigm. The marketplace aggregates listings from other marketplaces like LooksRare and OpenSea and allows traders to circumvent royalty fees.

They were also attached to the NFT project, “Art Gobblers” which was created by the co-founder of Rick and Morty. The project brought a lot of volume and attention to Blur.

If you bought or sold an NFT on Blur you were eligible for their 2/15 airdrop. They airdropped an insane $400m of tokens to users. Three users received more than $1.5m worth of Blur tokens.

SO… what happens from here?

Who knows

But in the past week, Blur is kicking OpenSea’s A** in total volume.

If this keeps up, the whole paradigm of NFT marketplaces will change.

Artists will be pissed off. OpenSea will do layoffs. And Blur’s gamble will pay off.

MEME

Oh, you've read this far and aren't subscribed? Do me a favor and hit that subscribe button

Rollfi Inc does not guarantee and is in no way responsible for the accuracy of information provided in this message. All information is provided “AS IS” and with all faults. Data presented here may not reflect all activity in the market.